In the unforgiving world of corporate communications, few mistakes are as costly as alienating your most powerful ally. Kraft Heinz learned this lesson the hard way when their routine announcement to split into two companies transformed into a public relations nightmare.

The Crisis Unfolds in Real Time

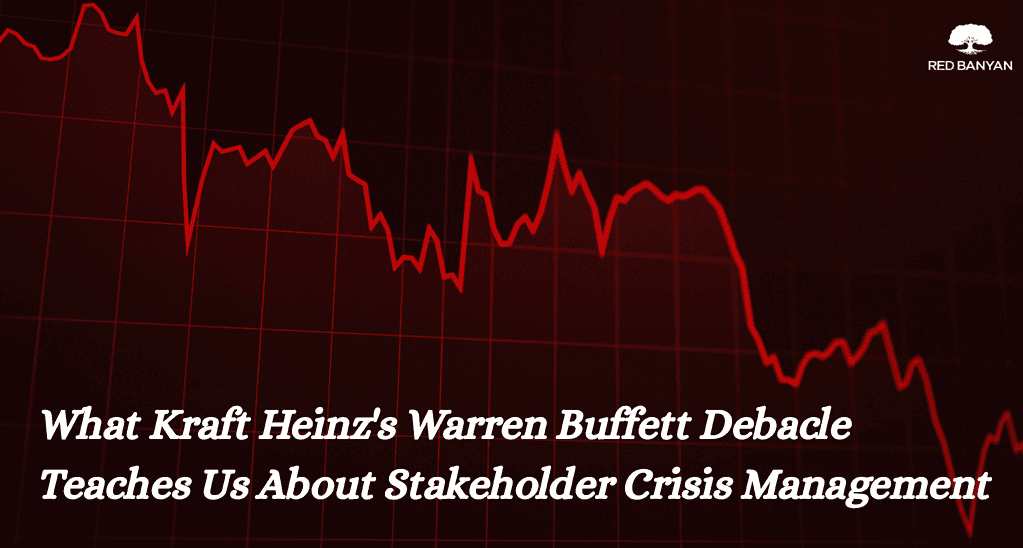

Warren Buffett, whose Berkshire Hathaway owns 27.5% of Kraft Heinz, didn’t mince words during his CNBC appearance. “It certainly didn’t turn out to be a brilliant idea to put them together, but I don’t think taking them apart will fix it,” he stated bluntly. The Oracle of Omaha had essentially declared their new strategy another mistake waiting to happen. The market responded immediately. Kraft Heinz shares plummeted 7% following Buffett’s remarks, wiping millions off the company’s market capitalization in a single trading session.

The Communication Breakdown That Started It All

According to Buffett’s own account, Berkshire Hathaway’s Greg Abel had tried to dissuade Kraft Heinz executives from moving forward with their decision during a meeting just one week earlier. This timeline reveals a critical error: Kraft Heinz proceeded with their public announcement despite knowing their largest investor opposed the plan. When your biggest supporter becomes your loudest critic, the damage extends far beyond stock price fluctuations.

Why Stakeholder Buy-In Matters More Than Ever

Kraft Heinz’s situation demonstrates several critical stakeholder management principles:

Influence Hierarchies Are Non-Negotiable: Warren Buffett’s investment philosophy and track record give his opinions outsized influence in financial markets. His criticism carries more weight than a dozen analyst downgrades combined.

Private Disagreements Can Become Public Disasters: When private stakeholder concerns become public knowledge, they transform from manageable business disagreements into reputation-threatening crises.

Timing Is Everything: Kraft Heinz announced their split during an already challenging period, having recently reported significant losses and facing declining sales in key products like Lunchables.

The Deeper Context Behind the Crisis

This public disagreement didn’t emerge in a vacuum. Kraft Heinz has lost approximately $57 billion in market value since their 2015 merger. The company previously announced a $15 billion write-down in 2019, with Buffett admitting that Berkshire had overpaid for Kraft.

Given this history, Buffett’s public criticism carries additional weight, suggesting broader concerns about management’s strategic capabilities.

Key Takeaways for PR Professionals

The Kraft Heinz crisis offers crucial lessons for communication professionals:

- Map Your Stakeholder Influence Network: Identify who has the power to amplify or undermine your message before making major announcements

- Secure High-Influence Buy-In First: Never proceed with announcements when key stakeholders remain opposed

- Prepare for Stakeholder Defection: Develop contingency communication strategies for scenarios where influential stakeholders publicly oppose your decisions

- Control the Narrative Timeline: Ensure stakeholder communications happen on your timeline, not theirs

The Road Ahead

Moving forward, Kraft Heinz faces the challenging task of executing their split strategy while managing an increasingly skeptical investment community. Their ability to rebuild investor confidence will depend on improved stakeholder engagement practices and successful execution of the separation process.

The Bottom Line

Kraft Heinz’s stakeholder communication failure demonstrates the real financial consequences of poor stakeholder management. For PR professionals, this situation underscores the critical importance of comprehensive stakeholder engagement before major announcements.

The lesson is clear: in stakeholder management, your biggest fan can quickly become your worst enemy if their concerns are ignored.

When stakeholder relationships turn toxic and corporate announcements become crisis moments, having experienced crisis communications professionals on your side makes all the difference. At Red Banyan, we help companies navigate complex stakeholder landscapes, secure critical buy-in before major announcements, and develop comprehensive crisis response strategies that protect your reputation when the stakes are highest. Don’t let a communication breakdown destroy years of relationship building.

Contact Red Banyan today to learn how our strategic PR and crisis communications services can help your organization maintain stakeholder trust and avoid reputation-damaging public confrontations.